Have you ever thought about using bitcoins to make purchases? If you have, then you may be wondering if there are any benefits or disadvantages for using this popular virtual currency. To understand what those pros and cons might be, let’s use a simple example. Let’s say that Jane is a consultant who works as…

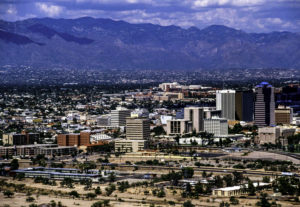

Convert Your Stock Gains into Real Estate and Pay Zero Taxes!

New, with the Tax Cuts and Jobs Act, you can take your gains from stock sales, invest in local Tucson real estate, and pay ZERO taxes! These are called Qualified Opportunity Zones. Here are the basics: What is an Opportunity Zone? An Opportunity Zone is an economically-distressed community. There are several zones in Tucson. Why…

How Our Spreadsheets Can Help You Track Your Expenses

When tax time rolls around, you may find yourself rushing to gather all of the financial information you need. If this sounds all too familiar, then an experienced certified public accountant can help. This year, don’t let yourself get overwhelmed by the prospect of doing your taxes on your own—turn to a professional for the…

How Tax Laws Are Changing in 2019

The Tax Cuts and Jobs Act of 2017 was signed into law a year and a half ago, but not all of its provisions took effect right away. In fact, many of the law’s sweeping changes will first become part of your life this year. If you’re wondering how the law will affect you, you…

Where’s My Refund?

If you haven’t yet received your income tax refund, you are not alone. The team at The Royce CPA Firm has all the information you need to help you track it down. Read through this post, and if you have any questions regarding your tax refund, or anything else tax related, feel free to give…

No Business Income Doesn’t Equal No Home Office Deduction

Running a home-based business can be a rewarding endeavor, especially when you take full advantage of all possible tax deductions. One commonly misunderstood example is the home office deduction. As long as you use your home office entirely for your business, you can usually deduct it. This holds true even if your startup didn’t turn…

Can I Deduct a Swimming Pool as a Medical Expense?

People have gotten away with deducting all sorts of crazy expenses on their tax returns—like the depreciation on ostriches and the cost of clarinet lessons. And yes, people have also gotten away with deducting a swimming pool as a medical expense. If you plan to try it, it’s a good idea to speak with a…

When and How to Deduct Medicare as a Business Expense

Medicare health insurance may be less expensive than most private plans, but the premiums still add up to a considerable sum each year. This is especially true for high-income taxpayers and married couples who are both paying Medicare premiums. However, a CPA may be able to help you deduct those premiums as a business expense….

TCJA Tax Reform: Did It Affect Employee Recreation and Parties?

Employee outings and parties are commonly used to build a positive company culture and reduce employee turnover rates. They’re also opportunities for the boss to get a break from the daily grind, and for a CPA to claim additional deductions for the business. The tax savings for employee outings has indeed survived the Tax Cuts…

Partnership QBI: Calculating and Improving It

For the Section 199A 20% tax deduction, profit distributions from partnerships are considered to be qualified business income (QBI). General partners are taxed based on these profit distributions, as well as guaranteed payments. Although the tax code is quite complicated in this area, it is possible to increase one’s QBI by increasing the profit distributions,…

Can You Deduct Your Home Office?

Lots of Americans work from a home office at least part of the time. It’s a convenient way to run a business, in part because it eliminates the morning commute. It can also offer tax advantages if you can claim the home office as a business deduction. It’s often thought that it’s only possible to…

When Can You Shred Your Personal Tax Documents?

Springtime isn’t just tax time—for many people, it’s also time to do spring cleaning. If you’re looking to clean out your files and get a fresh start, you may be wondering if it’s OK to shred your old tax documents. How long do you have to hold on to your past tax returns and your…

IRS Creates a New “Safe Harbor” for Section 199A Rental Properties

Under the new tax reform, Section 199A has been established to provide qualifying individual taxpayers and pass-through entities with a tax deduction of up to 20 percent of qualified business income (QBI). Section 199A also creates a “safe harbor” for owners of rental properties. If the filer qualifies for the safe harbor, the filer’s rental…

IRS Issues Final Section 199A Regulations and Defines QBI

The new IRS tax code Section 199A may affect you if you own a pass-through trade or business, including a proprietorship, partnership, or S corporation. It implements the new qualified business income (QBI) deduction, which may enable you to deduct up to 20 percent. QBI and Eligibility Essentially, qualified business income is taxable net income….

How to Report Prepaid Rent to the IRS

As a rule, it’s a good idea to avoid causing your landlord any potential tax problems. If you decided to prepay your business’ rent for 2019 to get a tax deduction for 2018, it’s important to report that correctly on your IRS Form 1099-MISC so that you don’t inadvertently cause a headache for your landlord….

IRS Announces It Will Waive Tax Penalties for People Who Under-Withheld for 2018

When the Tax Cuts and Jobs Act of 2017 passed, it made a number of changes to the current tax laws. As many taxpayers discovered, this included changes to the current withholding tables for federal income tax, As a result, many people found that they had under-withheld for their taxes this past year. If you…

What You Need to Know about Section 199A

One of the most notable tax deductions introduced by the Tax Cuts and Jobs Act of 2017 is the 20 percent deduction included in Section 199A. Although the IRS has already released its official regulations, the complexity of the tax deduction means that many people are still confused about what it means. Here are the…

A Look at Qualified Opportunity Funds

One of the tax planning strategies introduced by the Tax Cuts and Jobs Act of 2017 is qualified opportunity funds. By using these funds, you can defer any capital gains from the current year and then make the capital gains on your new investment tax-free. In order to do this, it’s important to understand how…

How the Recent Tax Changes Affect the Kiddie Tax

If your children have any unearned income, then your family may be affected by the so-called “kiddie tax.” How does the Tax Cuts and Jobs Act of 2017 affect you and your children? As you’ll see, tax planning can help you ensure that the impact on your family is minimal. First, it’s important to understand…

Deducting Your Business Vehicles

When the end of the year rolls around, it’s time to start looking at your inventory—including your current vehicles. If any of your cars, vans, trucks, or SUVs could be claimed for a tax deduction, now is the time to find out! Here’s what you need to know about how to do this. As a…